Real-time yield curves (hereinafter referred to as real-time curves) are based on benchmark bonds, with one-click deal prices in the interbank RMB trading system and the best bid and ask prices from Shanghai CFETS-ICAP International Money Broking Co., Ltd. being chosen and the real-time curve derived by linear interpolation. Among one-click deal prices and broker quotes, only prices for which the settlement timeframe is T+1 are chosen.

For real-time curves, the first curve is published at 9:30 on every trading day and the curve is updated hourly until 17:00.

I. Types of curves

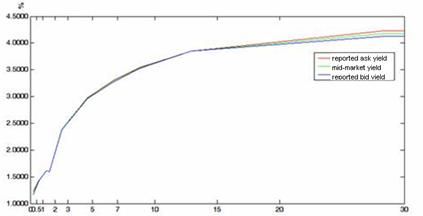

Real-time curves are yield to maturity curves and include the bid curve, the ask curve and the mid-market curve.

II. Types of benchmark bond

Real-time series include those for treasury bonds, policy bank bond(CDB), policy financial bonds(EIBC), policy financial bonds(ADBC), commercial paper (AAA), and medium-term notes (AAA). Bond samples are all chosen from fixed rate bonds, discount bonds, and zero coupon bonds, all of which are option-free bonds.

III. Method for constructing real-time curves

According to the terms of the benchmark bond scheme, benchmark bonds are chosen for each key term for each bond type in every sample selection period. Samples of treasury bonds, policy bank bond(CDB), policy financial bonds(EIBC), policy financial bonds(ADBC) and medium-term notes (AAA) are selected monthly and samples of commercial paper (AAA) is selected weekly.

In the valid period for every bond type, the best bid yield and the best ask yield for benchmark bonds in each standard term are selected in real time on every workday as shown in the table below.

| Standard Term(Year) | Benchmark Bond | Bond Maturity (Year) | Best Bid (%) | Best Ask (%) |

| 0.25 | 09 Discount Treasury Bond 20 | 0.2247 | 1.2400 | 1.1701 |

| 0.5 | 09 Interest-Bearing Treasury Bond 21 | 0.6767 | 1.4398 | 1.4298 |

| 1 | 08 Treasury Bond 04 | 1.2877 | 1.6100 | 1.6050 |

| 2 | 08 Treasury Bond 11 | 1.5370 | 1.6030 | 1.5950 |

| 3 | 09 Interest-Bearing Treasury Bond 15 | 2.5425 | 2.3900 | 2.3800 |

| 5 | 09 Interest-Bearing Treasury Bond 18 | 4.600 | 2.9800 | 2.9600 |

| 7 | 09 Interest-Bearing Treasury Bond 19 | 6.6384 | 3.3000 | 3.2650 |

| 10 | 08 Treasury Bond 18 | 8.7288 | 3.5400 | 3.5250 |

| 15 | 07 Special Treasury Bond 06 | 12.8877 | 3.8520 | 3.8500 |

| 30 | 08 Treasury Bond 06 | 28.3534 | 4.2296 | 4.1295 |

Take the bid interest rate as an example. The (maturity, best bid ) in the table are taken as a group of data which are drawn on the coordinate axis in scatter gram, with the scattered points being joined together by a straight line to form the real-time bid curve; the bid interest rate for the 30-year government bond real-time curve is designed to be equal to the bid interest rate for the 30-year benchmark bond, and if there is no interest rate for the 30-year benchmark bond, the real-time curve 30-year interest rate is left blank. Real-time ask curve data for treasury bonds are obtained in a similar manner; the mean curve represents the average of the bid curve and the ask curve and is shown in the table below.

The real-time best price table for benchmark bonds is also provided as follows:

| Standard Term(Years) | Benchmark Bond | Bond Maturity (Years) | Best Bid (%) | Best Ask (%) |

| 0.25 | 09 Discount Treasury Bond 20 | 0.2247 | 1.2400 | 1.1701 |

| 0.5 | 09 Interest-Bearing Treasury Bond 21 | 0.6767 | 1.4398 | 1.4298 |

| 1 | 08 Treasury Bond 04 | 1.2877 | 1.6100 | 1.6050 |

| 2 | 08 Treasury Bond 11 | 1.5370 | 1.6030 | 1.5950 |

| 3 | 09 Interest-Bearing Treasury Bond 15 | 2.5425 | 2.3900 | 2.3800 |

| 5 | 09 Interest-Bearing Treasury Bond 18 | 4.600 | 2.9800 | 2.9600 |

| 7 | 09 Interest-Bearing Treasury Bond 19 | 6.6384 | 3.3000 | 3.2650 |

| 10 | 08 Treasury Bond 18 | 8.7288 | 3.5400 | 3.5250 |

| 15 | 07 Special Treasury Bond 06 | 12.8877 | 3.8520 | 3.8500 |

| 30 | 08 Treasury Bond 06 | 28.3534 | 4.2296 | 4.1295 |

If the best quote for a benchmark bond changes, the real-time curve for the benchmark bond and

the real-time best price table are updated simultaneously.

IV. Price selection rules

Real-time curve data originate from one-click deal prices in the interbank RMB trading system and bond quotes from Shanghai CFETS-ICAP International Money Broking Co., Ltd., and among one-click deal prices and broker quotes, only prices for which the settlement timeframe is T+1 are chosen; prices are divided into real-time prices, intraday prices, broker quotes, and historic prices according to the time and effectiveness of the price.

The order of priority for price selection is effective real-time one-click prices, intraday click prices that are no longer effective, prices from currency brokerage companies, and historic prices. Taking bid prices as an example, the price selection rules are as follows:

Real-time prices: the lowest price among effective one-click bid prices for the benchmark bond at the time of publication is selected as the best bid price for the benchmark bond.

Intraday prices: the last effective one-click price before the time of publication is selected as the representative price.

Broker quotes: the bid price for the benchmark bond among broker quotes at the time of publication is selected.

Historic prices: if the benchmark bond has no bid click deal price or broker quotes before the time of publication, the date of the last bid price for click transactions or the last bid price from currency brokerage companies for the bond is selected, and the interest rate for the best bid price for the benchmark bond at 17:00 on that date is selected as the representative interest rate at the time of intraday publication.

V. Automatic bond substitution mechanism for benchmark bonds

Because the basket of benchmark bonds is obtained by calculating statistics based on historical market-making quotation data, quotes may not be updated on subsequent trading days, in which case the benchmark bond scheme will initiate the automatic bond substitution mechanism and market participants will be promptly informed. The automatic bond substitution mechanism is as follows:

Priority selection of newly issued bonds:

If there has been no benchmark bond price for a key rate duration for N consecutive days (5 days in general) and new bonds are issued during the valid period, new bonds with bilateral quotes in the last N days (5 days in general) will be given prior consideration; if two or more new bonds satisfy these conditions, bond substitutions will be carried out in the following order: average number of market-making institutions, issue date, issuance volume, bond code.

Secondly, selection of sample bonds:

If a new bond cannot be selected, the automatic bond substitution mechanism may be implemented and the bond with bilateral quotes in the last N days (5 days in general) and the highest score among the sample bonds during the standard period will be regarded as the benchmark bond for the residual term of the valid period. If the selected bond has not been priced for N consecutive days (5 days in general) during the valid period, the principles for changing the benchmark bond will be the same as above.

Ongoing selection of bonds:

If the bond is not selected through the two steps described above, the benchmark bond will not change on that day and the applicable interest rate for the period will be the historic price interest rate for the bond. The benchmark bond will be selected according to the two steps described above on the following day.